State Support

BPA is supporting states like yours through workforce development, partnerships, research, and collaboration.

JOIN US

Become a Member

BPA membership offers tailored resources to professionals in energy efficiency and weatherization, ensuring you stay at the forefront of the industry. You'll gain access to a member-only resource library, regular updates, cost savings, and more.

Engaging meetings, events, and networking opportunities

Valuable training, resources, and education

Grow your business and ensure professional success

Recent State Updates

Our Team

Working For You

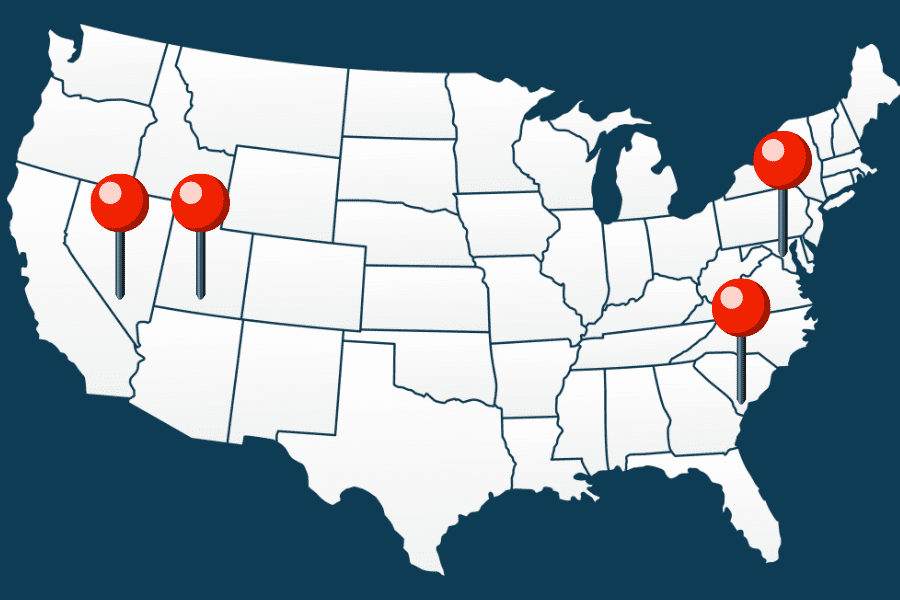

We have a growing state outreach team working from various parts of the country to organize at the state level, advise state governments on how best to use their resources, and, ultimately, advance the home performance industry.